Madison’s Reporter: Lumber Prices Flatten as Sales Volumes Continue to Rise

Lumber end-users and resellers alike shed their reluctance of the past few months to make purchases, as prices have returned to what would be considered historically “normal” levels. Once again inventories were extremely lean, as those who could wait to buy wood did so. The previously stratospheric price levels of spring were a long-distant memory, providing confidence to buyers that now was the time to pounce. Meanwhile, housing construction activity across the US and Canada remains quite strong, with the latest data releases suggest there will be ongoing demand throughout autumn.

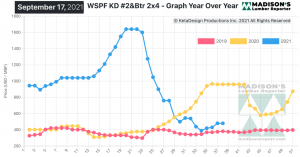

After rising incrementally since Labour Day, for the week of September 17, 2021 the price of Western S-P-F 2×4 #2&Btr KD (“RL”) remained flat at US$480 mfbm. That week’s price was up by +$33, or +7%, from one month ago when it was $447.

As volumes were cleaned up by hungry customers who had let their stocks run down, there was a a much-needed boost of inquiry for low-grade offerings.

“Dimension lumber and stud items again experienced limited availability, while prices and demand for panels were flat.” – Madison’s Lumber Reporter

Tight inventories Western S-P-F commodities in the US were again a problem as scores of buyers jumped into the fray to book purchases, only to find supply was low. Players reported that getting price quotes back from Spruce-Pine-Fir sawmills was a persistent challenge. One of the main culprits of low supply was difficulty in sourcing trucks. Personnel and equipment shortages caused delays of at least one week, and that was only if the supplier had material on the ground.

Western S-P-F producers in Canada described a steadily improving lumber demand, with inquiry and follow-through purchases increasing as the week wore on. Order files ranged from one- to three-weeks out depending on the sawmill and item. Buyers who had been practicing fence-sitting came down from their perches, as construction markets across the continent bloomed.

“Sales of Southern Yellow Pine lumber and studs advanced. Regardless, sawmills continued to have trouble making higher prices stick. A few mills went off the market on 2×4, while, at two weeks, 2×12 garnered the longest order file of any SYP dimension commodity. ” – Madison’s Lumber Reporter

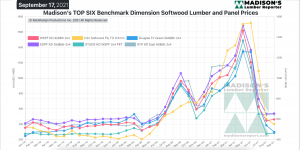

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages

When compared to the same week last year, of $960, the price of Western S-P-F 2×4 for the week of September 17, 2021 was down by -$480, or -50%. Compared to two years’ ago when it was $382, that week’s price was up by +$98, or +26%.

About Madison’s Lumber Reporter

Established in 1952, Madison’s Lumber Prices is your premiere source for North American softwood lumber news, prices, industry insight, and industry contacts. The weekly Madison’s Lumber Reporter publishes current Canadian and US construction framing dimension lumber and panel wholesaler pricing information 50 weeks a year and access to historical pricing as well.

Contact:

Keta Kosman – Publisher, Madison’s Lumber Reporter – (604) 319-2266 –www.madisonsreport.com

Source: Madison’s Lumber Reporter