Financial Statement Basics: What is a balance sheet?

Four documents—the balance sheet, income statement (or profit and loss statement), cash flow statement, and statement of owner’s equity—make up what the financial world calls “financial statements.”

Each is interwoven with the others and necessary to fully analyze the financial position of a company.

The balance sheet shows the financial position of a company on a specific date. A company’s balance sheet position reveals its ability to pay short-term obligations within terms, to evaluate and assess financing options, and to withstand unexpected expenses. It includes assets, liabilities, and owner’s equity.

Assets are resources owned by a company, while equities are rights or claims against said resources. If a company has $100,000 in assets, it also has $100,000 in claims against these assets. The relationship, written as an equation, is assets = equities.

Equities can be further subdivided into claims of creditors or claims of owners. Claims of creditors are called liabilities, while claims of owners are called owner’s equity. The equation just shown can then be expanded to assets = liabilities + owner’s equity.

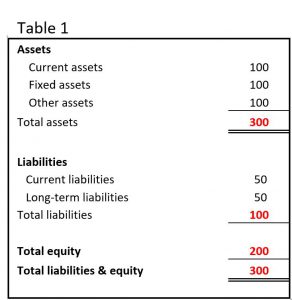

This is known as the “basic accounting equation.” Assets must equal the sum of liabilities and owner’s equity. Table 1 reflects the basic format of a balance sheet depicting the general flow of this equation.

Assets

The asset section of the balance sheet can generally be broken down into three sections: current assets, fixed assets, and other assets, as seen in Table 1.

Current assets are cash and other resources that are reasonably expected to be realized in cash, or sold or consumed in the business within one year of the balance sheet date, or the company’s operating cycle.

Other current assets might include accounts receivable, inventory, marketable securities, and prepaid expenses, among others.

Current assets are a business’ most liquid assets (liquidity refers to the ease with which these assets can be converted to cash) and are very important to a company’s ability to handle its obligations and expenses.

Fixed assets are tangible resources that are relatively permanent in nature, used in the business, and not intended to be sold. They might include land, buildings, machinery, equipment, furniture, and fixtures. These assets are considered less liquid and used to operate the business.

Other assets are often referred to as intangible assets, and might include goodwill, patents, and/or trademarks. They may also include various notes receivable from company officers or employees, or cash surrender values of insurance. These, too, are less liquid.

Liabilities

Current liabilities are the counterpart to current assets. They are obligations that are reasonably expected to be paid from existing current assets or with other current liabilities within one year.

Current liabilities might include accounts payable, use of a line of credit, wages and salaries, taxes, and current maturities of long-term debt.

The relationship between current assets and current liabilities is important when evaluating a company’s liquidity, or its ability to pay obligations expected to be due within one year.

When current assets exceed current liabilities, the likelihood of paying current liabilities is favorable; when the reverse is true, liquidity may be a concern.

Long-term liabilities are obligations expected to be paid after one year. Such liabilities are often a mortgage or vehicle note, or other debt associated with bank financing.

Equity

Owner’s equity is the owner’s claim on the business and is equal to total assets minus total liabilities. It is the value remaining after all liabilities have been subtracted from all assets.

Owner’s equity is essentially ownership investment and increases on company profitability or additional paid-in capital, and declines on losses or capital draws. A positive owner’s equity number, derived from profits, is most desired.

Liquidity

Managing a company for financial health is about being able to look at the big picture through the details of a company’s financial statements, or in this case, the company’s balance sheet.

It’s important to know how liquid or leveraged a company is, as of the date presented. Leverage refers to the amount of borrowed capital in use by a company to expand its asset base and will be addressed in Part 2 of this online series.

Source: Blue Book Services, Inc.