LP Building Solutions Reports Second Quarter 2023 Results

Louisiana-Pacific Corporation (LP) (NYSE: LPX), a leading manufacturer of high-performance building products, today reported its financial results for the three and six months ended June 30, 2023.

Key Highlights for Second Quarter 2023, Compared to Second Quarter 2022

- Siding Solutions net sales decreased by 11% to $318 million on lower volumes partially offset by higher prices

- Oriented Strand Board (OSB) net sales decreased by 66% to $229 million, primarily due to lower prices

- Consolidated net sales decreased by 46% to $611 million

- Income (loss) attributed to LP from continuing operations decreased by $367 million to $(20) million (or $(0.28) per diluted share) due in part to one-time charges detailed below

- Adjusted EBITDA(1) was $93 million, a decrease of $398 million

- Adjusted Diluted EPS(1) was $0.55 per share, a decrease of $3.64 per share

- Cash provided by operating activities was $88 million

| (1) | This is a non-GAAP financial measure. See “Use of Non-GAAP Information”, “Reconciliation of Net Income to Non-GAAP Adjusted EBITDA, Non-GAAP Adjusted Income, and Non-GAAP Adjusted Diluted EPS” below. |

Capital Allocation Update

- Paid $80 million to acquire Wawa facility assets

- Paid $74 million in capital expenditures during the second quarter

- Paid $17 million in cash dividends during the second quarter

- Declared a quarterly cash dividend of $0.24 per share

- Amended Credit Facility balance of $30 million as of June 30, 2023

- Cash and cash equivalents of $71 million as of June 30, 2023

- Availability of $200 million remaining under the 2022 Share Repurchase Program

“LP earned $93 million in EBITDA in the quarter while operating with exceptional safety and efficiency,” said Brad Southern, Chair & Chief Executive Officer. “As the housing outlook continues to improve, I am confident that LP’s strategy positions us well for long-term growth.”

Outlook

Our guidance is based on current plans and expectations and is subject to a number of known and unknown uncertainties and risks, including those set forth below under “Forward-Looking Statements.”

- Siding Solutions full year 2023 revenue is expected to decrease year-over-year by approximately 10%

- OSB third quarter 2023 revenue is expected to be sequentially higher than the second quarter 2023 by at least 50%, assuming that OSB prices published by Random Lengths remain unchanged from those published on July 28, 2023 (this is an assumption for modeling purposes and not a price forecast)

- Under these assumptions, third quarter 2023 Adjusted EBITDA(2) is expected to be in the range of $160 million and $180 million

- Given our current outlook, capital expenditures for 2023 are expected to be in the range of $290 million to $310 million, including $120 million to $130 million for mill conversions, $120 million to $125 million for sustaining maintenance, and $50 million to $55 million for other strategic growth projects

| (2) | This is a non-GAAP financial measure. With respect to Adjusted EBITDA for the second quarter of 2023, certain items that affect net income on a GAAP basis, such as business exit charges, product-line discontinuance charges, other operating credits and charges, net, loss on early debt extinguishment, investment income, and other non-operating items, that would be required to be included in the comparable forecasted GAAP measures cannot be reasonably predicted at this time, and LP is unable to quantify such amounts that would be required to be included in the comparable forecasted GAAP measures, without unreasonable effort. As such, the Company is unable to provide a reasonable estimate of GAAP net income, or a corresponding reconciliation of Adjusted EBITDA to net income. |

Second Quarter 2023 Highlights

Net sales for the second quarter of 2023 decreased year-over-year by $519 million (or 46%). This included a decrease in OSB segment revenue of $444 million or 66%, driven by 57% lower average selling prices and 21% lower volumes. Siding segment revenue decreased $37 million or 10%, due to 16% lower volume offset by 6% higher prices. The remaining decrease in net sales was related to decreases in South America segment and other revenue of $18 million and $20 million, respectively.

Income (loss) attributed to LP from continuing operations for the second quarter of 2023 decrease year-over-year by $367 million (or 106%) to $(20) million, or $(0.28) per diluted share. This primarily reflects a $398 million decrease in Adjusted EBITDA, $34 million of business exit charges (of which, $30 million were non-cash charges) related to an off-site framing operation (Entekra Holdings, LLC), and $16 million of settlements of OSB patent-related claims, partially offset by a $95 million lower income tax provision.

First Six Months of 2023 Highlights

Net sales for the first six months of 2023 decreased year-over-year by $1,102 million (or 48%). This included a decrease in OSB revenue of $998 million or 70%, due to 61% lower prices and 24% lower volume. Siding segment revenue decreased $38 million or 5%, due to 13% lower volume offset by 8% higher prices. The remaining decrease in net sales was related to decreases in South America segment and other revenue of $29 million and $38 million, respectively.

Income attributed to LP from continuing operations for the first six months of 2023 decreased year-over-year by $768 million (or 100%) to $1 million, or $0.02 per diluted share. The decrease primarily reflects a $930 million decrease in Adjusted EBITDA, $34 million of business exit charges (of which, $30 million were non-cash charges) related to an off-site framing operation (Entekra Holdings, LLC), and $16 million of settlements of OSB patent-related claims, partially offset by a $218 million lower income tax provision.

Segment Results

Siding

The Siding segment serves diverse end markets with a broad product offering of engineered wood siding, trim, and fascia, including LP® SmartSide® Trim & Siding, LP® SmartSide® ExpertFinish® Trim & Siding, LP BuilderSeries® Lap Siding, and LP® Outdoor Building SolutionsTM (collectively referred to as Siding Solutions).

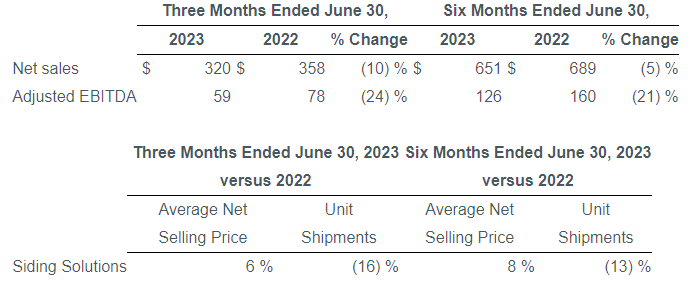

Segment sales and Adjusted EBITDA for this segment were as follows (dollar amounts in millions):

The effects of list price increases drove year-over-year increases in the average net selling price for the three and six months ended June 30, 2023. The volume decreases for the three and six months ended June 30, 2023 were driven by challenging new and existing home selling markets and elevated levels of channel inventory compared to the prior periods.

Adjusted EBITDA decreased year-over-year by $19 million in the second quarter of 2023, reflecting the net impact of lower volumes, $6 million of raw material inflation, and $6 million of discretionary investments in support of future growth, including siding mill conversions and sales and marketing costs, partially offset by higher average selling prices. The year-over-year decrease in Adjusted EBITDA of $34 million for the six months ended June 30, 2023, reflects the net impact of lower volumes, $20 million of raw material inflation, and $9 million of discretionary investments in support of future growth, including siding mill conversions and sales and marketing costs, partially offset by higher average selling prices.

Oriented Strand Board (OSB)

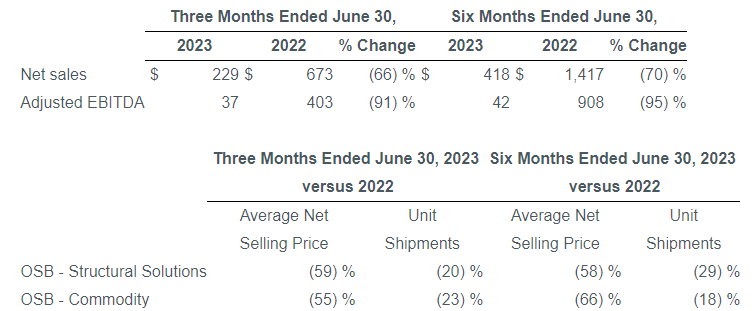

Segment sales and Adjusted EBITDA for this segment were as follows (dollar amounts in millions):

The OSB segment manufactures and distributes OSB structural panel products including our value-added OSB portfolio known as LP® Structural Solutions (which includes LP® TechShield® Radiant Barrier, LP WeatherLogic® Air & Water Barrier, LP Legacy® Premium Sub-Flooring, LP NovaCore® Thermal Insulated Sheathing, LP® FlameBlock® Fire-Rated Sheathing), and LP® TopNotch® Sub-Flooring). OSB is manufactured using wood strands arranged in layers and bonded with resins.

The year-over-year net sales decrease of $444 million for the three months ended June 30, 2023 reflects a $368 million decrease in OSB prices, a $33 million decrease in sales volume from production curtailments, and a $28 million decrease related to production volume from the conversion of our Sagola, Michigan mill to siding production. The year-over-year net sales decrease of $998 million for the six months ended June 30, 2023 reflects an $838 million decrease in OSB prices, an $84 million decrease in sales volume from production curtailments, and a $55 million decrease related in production volume from the conversion of the Sagola mill to siding production.

The year-over-year decreases in Adjusted EBITDA of $366 million and $866 million for the three and six months ended June 30, 2023, respectively, reflects lower OSB prices and sales volumes (as described above), partially offset by lower mill-related costs.

South America

LP’s South America segment manufactures and distributes OSB structural panel and siding products in South America and certain export markets. This segment has manufacturing operations in two countries, Chile and Brazil, and operates sales offices in Chile, Brazil, Peru, Colombia, Argentina, Paraguay, and Mexico.

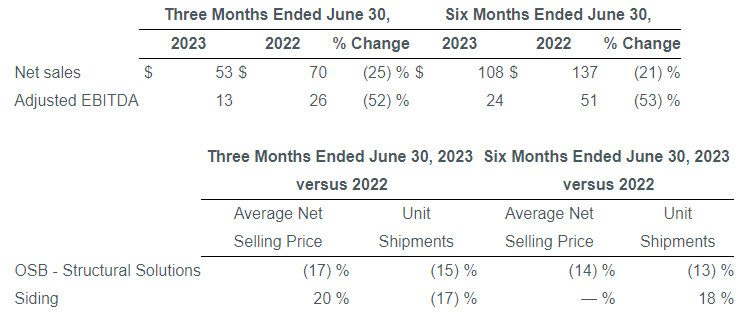

South America net sales decreased year-over-year by $18 million and $29 million for the three and six months ended June 30, 2023, respectively, predominantly driven by lower OSB sales volumes and average selling prices.

The year-over-year decrease in Adjusted EBITDA of $14 million and $27 million for the three and six months ended June 30, 2023, respectively, reflects the lower sales volumes and average selling prices (described above) as well as higher raw material costs.

For the complete press release, click here.

About LP Building Solutions

As a leader in high-performance building solutions, Louisiana-Pacific Corporation (LP Building Solutions, NYSE: LPX) manufactures engineered wood building products that meet the demands of builders, remodelers, and homeowners worldwide. LP’s extensive offerings include innovative and dependable building products and accessories, such as Siding Solutions (LP® SmartSide® Trim & Siding, LP® SmartSide® ExpertFinish® Trim & Siding, LP BuilderSeries® Lap Siding, and LP® Outdoor Building Solutions™), LP Structural Solutions (LP® TechShield® Radiant Barrier, LP WeatherLogic® Air & Water Barrier, LP Legacy® Premium Sub-Flooring, LP® FlameBlock® Fire-Rated Sheathing, LP NovaCore™ Thermal Insulated Sheathing, and LP® TopNotch®350 Durable Sub-Flooring), and oriented strand board (OSB). In addition to product solutions, LP provides industry-leading customer service and warranties. Since its founding in 1972, LP has been Building a Better World™ by helping customers construct beautiful, durable homes while our stockholders build lasting value. Headquartered in Nashville, Tennessee, LP operates 22 plants across the U.S., Canada, Chile, and Brazil. For more information, visit LPCorp.com.

Contact:

Aaron Howald – Investor Contact – Aaron.Howald@lpcorp.com – (615) 986-5792

Source: Louisiana-Pacific Corporation