Quanex Building Products Announces Third Quarter 2023 Results and Updates Full Year 2023 Guidance

Quanex Building Products Corporation (“Quanex” or the “Company”) today announced its results for the three months ended July 31, 2023.

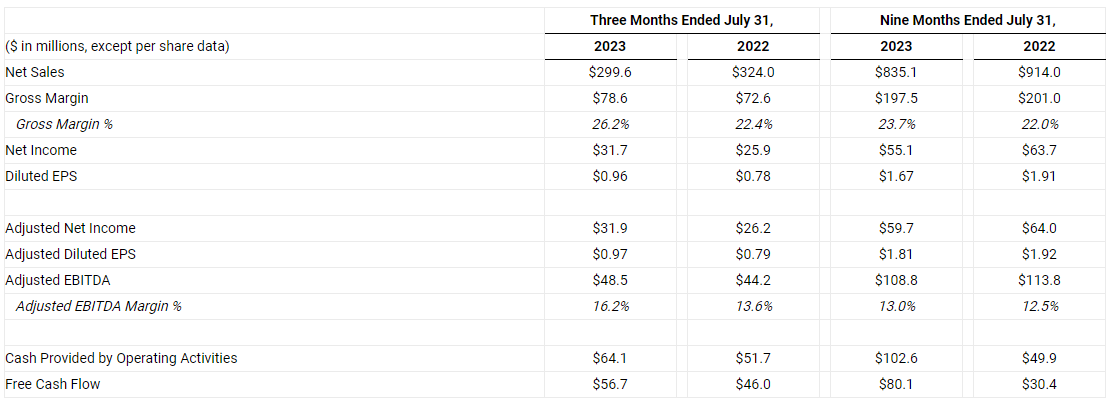

The Company reported the following selected financial results:

(See Non-GAAP Terminology Definitions and Disclaimers section, Non-GAAP Financial Measure Disclosure table, Selected Segment Data table and reconciliation tables for additional information)

George Wilson, President and Chief Executive Officer, stated, “The results we reported for the three months ended July 31, 2023 were a record for Quanex from both an earnings and margin perspective. Demand continued to improve across all product lines during the third quarter of this year compared to the first half of the year. In addition, we believe the customer inventory rebalancing that impacted results in our fenestration segments in the first half have subsided and did not affect third quarter results.

“When compared to the third quarter of 2022, revenue declined in the third quarter of 2023 across all operating segments as ongoing macroeconomic challenges led to market volume declines and some pricing pressure, mostly due to surcharge rollbacks and index pricing decreases in North America as raw material costs declined. Despite this pressure on the topline, we converted well and realized margin expansion across all operating segments. Our continued focus on operational efficiency proved beneficial and our ability to flex our cost structure to meet demand trends across product lines also helped improve our profitability during the quarter.

“We continue to do a good job of managing working capital and generating cash, which enabled us to pay down our bank debt by $25 million during the third quarter. In fact, we are currently on track to generate record free cash flow this year. In addition, our balance sheet remains strong, and our leverage ratio improved compared to the second quarter of this year.” (See Non-GAAP Terminology Definitions and Disclaimers section for additional information)

Third Quarter 2023 Results Summary

The Company reported net sales of $299.6 million during the three months ended July 31, 2023, which represents a decrease of 7.5% compared to $324.0 million for the same period of 2022. The decrease was mostly attributable to softer market demand and lower pricing in North America. Quanex realized a decline in net sales of 4.1% for the third quarter of 2023 in its North American Fenestration segment. Excluding the contribution from the LMI Custom Mixing assets we acquired on November 1, 2022, net sales in the North American Fenestration segment would have declined by 14.9% year-over-year. The Company reported a decline in net sales of 23.6% in its North American Cabinet Components segment and a decrease of 2.8% in net sales in its European Fenestration segment, excluding foreign exchange impact. (See Sales Analysis table for additional information)

The increase in earnings for the three months ended July 31, 2023 was largely attributable to operational efficiency gains, cost control and a decrease in income tax expense. As such, Quanex was able to realize margin expansion in each of its operating segments and on a consolidated basis.

Balance Sheet Update

As of July 31, 2023, Quanex had total debt of $110.8 million ($57.9 million excluding real-estate leases that are considered “finance” leases under U.S. GAAP) and the Company’s leverage ratio of Net Debt to LTM Adjusted EBITDA decreased to 0.3x (Net Debt free excluding these real-estate leases). As of July 31, 2023, Quanex’s LTM Adjusted EBITDA was $147.5 million and LTM Net Income, the most directly comparable GAAP measure, was $79.8 million. (See Non-GAAP Terminology Definitions and Disclaimers section, Net Debt Reconciliation table and Last Twelve Months Adjusted EBITDA Reconciliation table for additional information)

Outlook

Mr. Wilson commented, “We were cautiously optimistic heading into the second half of our fiscal year based on our belief that we were seeing a return to normal seasonality. Our third quarter results reinforced that belief. Based on our results year-to-date, combined with our operational execution, recent demand trends and conversations with our customers, we are updating our guidance for fiscal 2023. On a consolidated basis for fiscal 2023, we currently estimate that we will generate net sales of approximately $1.125 billion, which is towards the lower end of prior guidance as indicated on our last earnings call; however, we are increasing our Adjusted EBITDA* guidance to $150 million to $155 million.

Our capital allocation priorities continue to be generating cash, paying down debt, evaluating growth opportunities and opportunistically buying back our stock.”

*When Quanex provides expectations for Adjusted EBITDA on a forward-looking basis, a reconciliation of the differences between the non-GAAP expectations and corresponding GAAP measures is generally not available without unreasonable effort. Certain items required for such a reconciliation are outside of the Company’s control and/or cannot be reasonably predicted or estimated, such as the provision for income taxes.

For the full third quarter results, click here.

About Quanex

Quanex is a global manufacturer with core capabilities and broad applications across various end markets. The Company currently collaborates and partners with leading OEMs to provide innovative solutions in the window, door, vinyl fencing, solar, refrigeration and cabinetry markets. Looking ahead, Quanex plans to leverage its material science expertise and process engineering to expand into adjacent markets.

Contact:

Scott Zuehlke – Senior Vice President, Chief Financial Officer & Treasurer – scott.zuehlke@quanex.com – (713) 877-5327

Source: Quanex Building Products Corporation