Madison’s Reporter: Lumber Prices Tick Up Slightly Even as Demand Remains Low

At this time of year, the historical trend would normally be for lumber prices to be rising. Usually by mid-April the building activity for housing is ramping up, and sales volumes of construction framing lumber are approaching their high for the year. This year, however, is proving to be quite the exception. The biggest reason for this has been an extended winter, with cold weather — and even freezing conditions — ongoing throughout the continent even this month. For builders this is a problem, especially for brand-new projects which require concrete foundations to be poured. As the entire industry waits for normal balmy temperatures to consistently arrive, the demand for lumber and wooden building materials is soft indeed. This, of course, means prices this year have not yet started their annual climb.

Check back with the Madison’s website www.madisonsreport.com regularly to be informed of what to look for next.

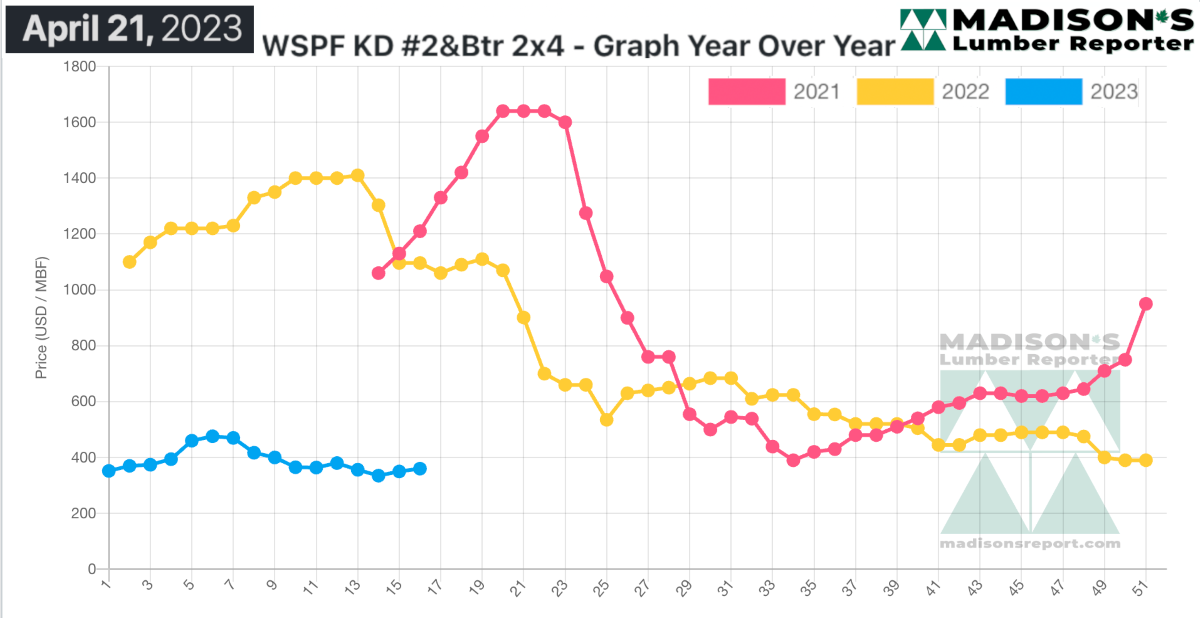

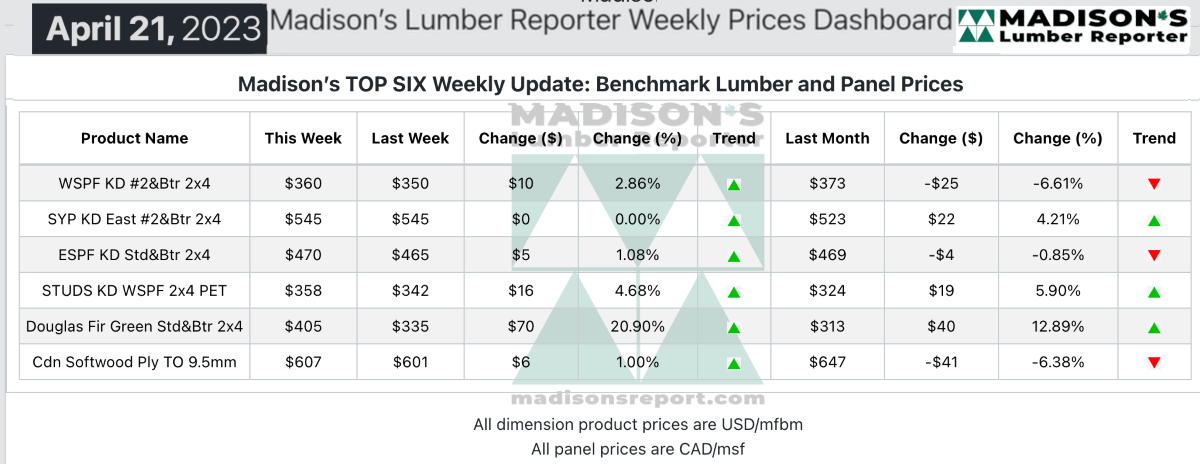

In the week ending April 21, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$360 mfbm, which is up by +$10, or +3%, from the previous week when it was $350, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is down by -$13, or -3%, from one month ago when it was $373.

Buyers continued to avoid taking anything resembling a long position, preferring to subsist on hand-to-mouth deals instead.

“Encouraging signs came from various pockets of the North American solid wood commodities market, but sales activity overall continued to fall short of typical spring levels.” — Madison’s Lumber Reporter

Buyers of Western S-P-F lumber and studs in the United States maintained their cautious approach this week. Sales volumes were better into certain regions, but overall demand continued to fall short of typical spring levels. Sales of low-grade lumber remained strong, while #2&Btr 2×4 R/L emerged as the most sought-after width as buyers pursued coverage for upcoming construction projects. WSPF stud trims experienced steady demand throughout the week. Sawmills found success with higher numbers on narrows, while wides were weak by comparison. Order files stretched into the week of May 8th.

The Western S-P-F dimension market settled into a more stable pattern over the course of this week. Canadian producers adjusted their asking prices again, with most items remaining at or on either side of last week’s levels. Four-inch R/L experienced strong inquiry and takeaway the whole week according to both primary and secondary suppliers. Meanwhile, wides were apparently a struggle by contrast.

“Canadian suppliers of Western S-P-F studs reported improved activity as buyers on both sides of the border were busier than in recent weeks. Those from the US were decidedly livelier, while the Canadian market was still slowly coming out of hibernation. Producers pushed their asking prices up on all trims aside from overabundant 2×6-8’s. The scarcest and strongest in-demand trim was again 2×6-9’. Stud mills extended their order files into the first half of May.” — Madison’s Lumber Reporter

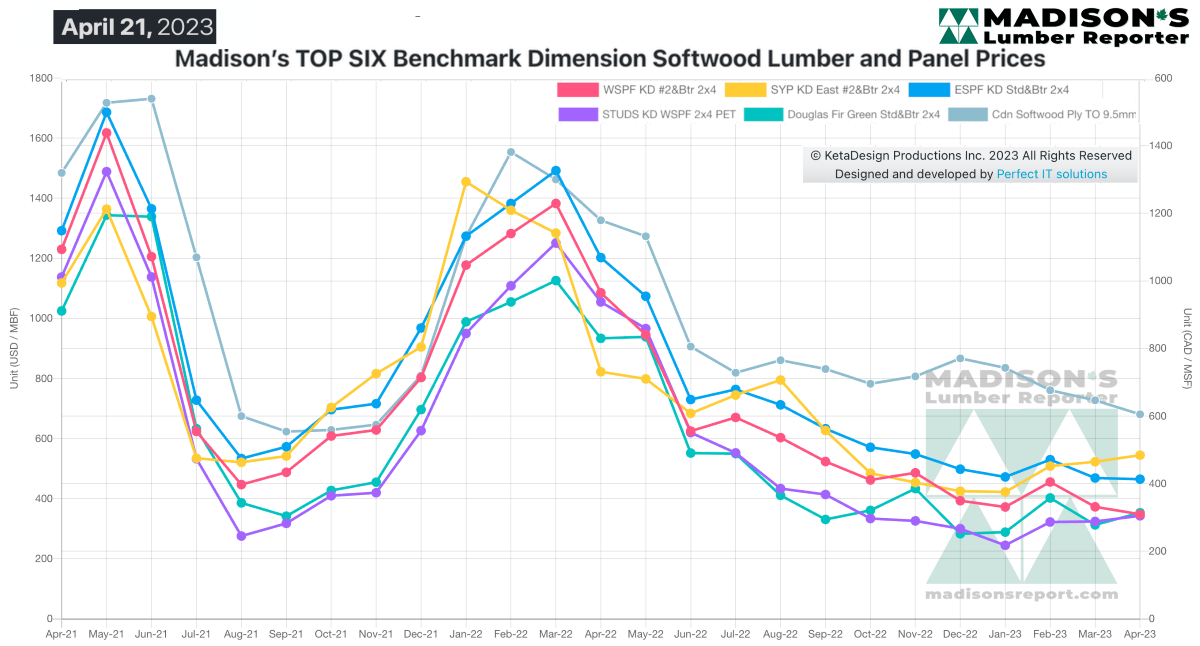

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages

Compared to the same week last year, when it was US$815 mfbm, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending April 21, 2023 was down by -$270, or -33%. Compared to two years ago when it was $1,090, that week’s price is down by -$545, or -50%.

About Madison’s Lumber Reporter

Established in 1952, Madison’s Lumber Prices is your premiere source for North American softwood lumber news, prices, industry insight, and industry contacts. The weekly Madison’s Lumber Reporter publishes current Canadian and US construction framing dimension lumber and panel wholesaler pricing information 50 weeks a year and access to historical pricing as well.

Contact:

Keta Kosman – Publisher, Madison’s Lumber Reporter – (604) 319-2266 – https://madisonsreport.com/

Source: Madison’s Lumber Reporter